Understanding the Foreclosure Process in Canada

In Canada, when a homeowner stops making mortgage payments, the lender has the legal right to begin the foreclosure process. The property serves as collateral for the mortgage loan. When the property is sold, sale proceeds that exceed the outstanding mortgage balance are returned to the homeowner. However, if the sale price does not cover the full mortgage balance, the lender may seek legal action to recover the remaining amount from the homeowner.

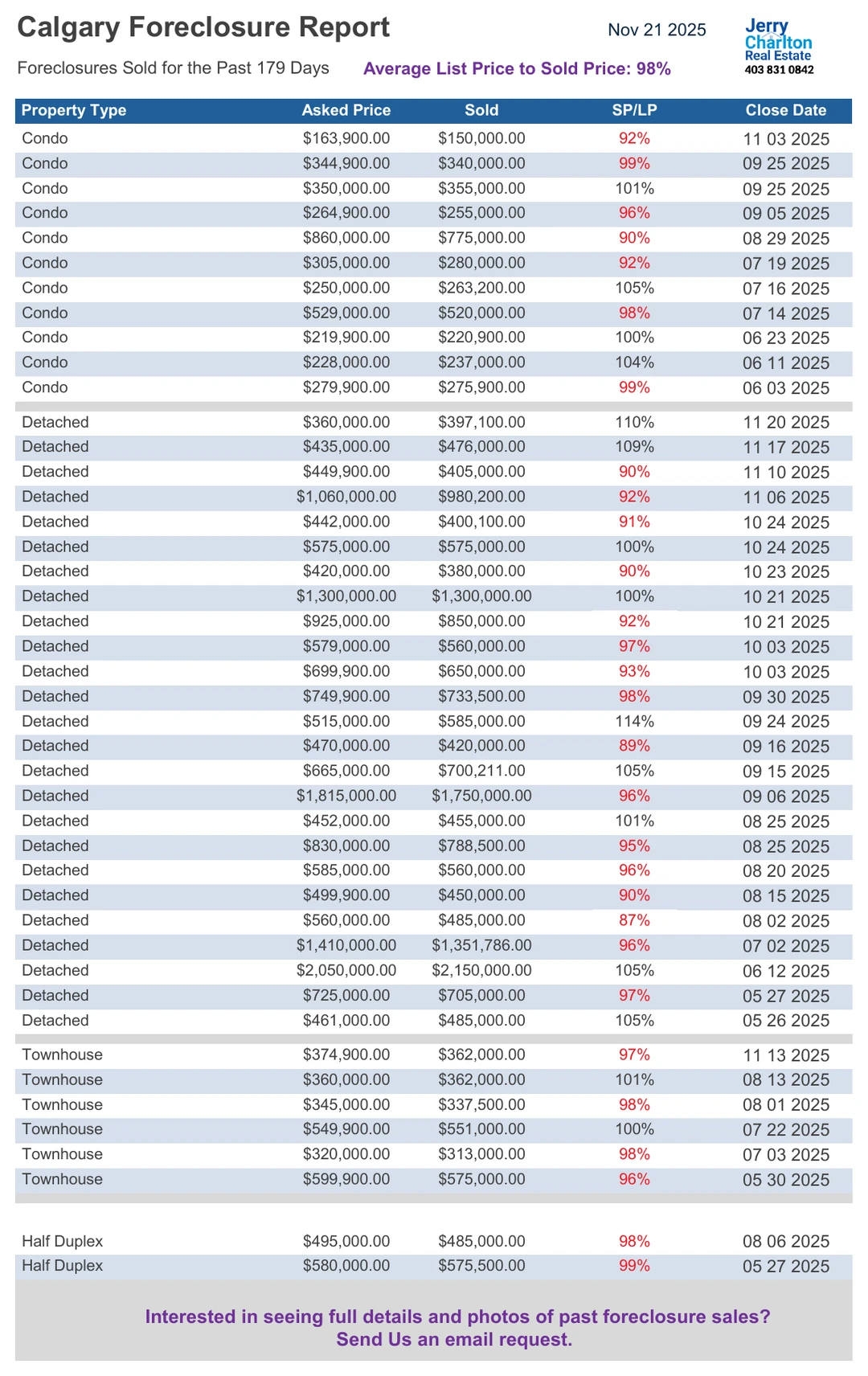

Importantly, in Canada, foreclosures are required to be sold at or near market value. Whether the seller is a bank or a court-appointed trustee, they are prohibited by law from selling a property at fire sale prices. Lowball offers will not be entertained or countered. Foreclosure Offers to Purchase are structured similarly to regular Offers to Purchase, but with a few key differences

If you're interested in purchasing a foreclosure in Canada, we only work with serious buyers who sign our Buyer Brokerage Agreement and provide a non-refundable deposit. We help you find and buy foreclosed real estate.

Calgary Foreclosures For Sale Today From All Mortgage Lenders and The Courts of Alberta - Updated Daily - Bookmark This Page

-

1010 924 14 Avenue SW | Beltline | Apartment

1010 924 14 Avenue SW Beltline Calgary T2R 0N7 $219,900Residential- Status:

- Active

- MLS® Num:

- A2207233

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 972 sq. ft.90 m2

**JUDICAL LISTING** Welcome to Dorchester Square, with a prime downtown location offering convenience for shopping and dining. This spacious 2-bedroom, 1-bath condo on the 10th floor offers downtown and city views from its prime corner suite location. Lots of large windows flood the space with natural light, while the private balcony provides the perfect spot to take in Calgary’s stunning skyline. Located in the heart of the Beltline, this home is surrounded by top-tier restaurants, trendy bars, and boutique shops, placing you in the center of the city’s most vibrant community. Dorchester Square is a well-managed concrete building featuring a fully equipped fitness center with a squash court, a social/games room, a billiards room, a recreation lounge, a beautifully landscaped outdoor courtyard, and a second-floor patio for relaxing or socializing. With easy access to transit, parks, and the downtown core, this Beltline gem offers the perfect blend of style, convenience, and urban energy. Don’t miss this incredible opportunity More detailsListed by Graham Realty Inc.- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

2211 2600 66 Street NE | Pineridge | Apartment

2211 2600 66 Street NE Pineridge Calgary T1Y 6M7 $228,000Residential- Status:

- Active

- MLS® Num:

- A2207909

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 836 sq. ft.78 m2

Great Investment Opportunity in Pineridge! This spacious 2-bedroom, 2-bathroom condo offers an excellent layout with the bedrooms located on opposite sides of the unit for added privacy. The primary bedroom features its own ensuite bathroom and a walk-through closet. Enjoy the open-concept living and dining areas, perfect for entertaining. A west-facing balcony brings in plenty of natural light and offers a great space to relax. Conveniently located near shopping, schools, public transit, and major routes, this condo is ideal for those seeking both comfort and convenience. Don’t miss out on this fantastic opportunity! More detailsListed by RE/MAX House of Real Estate- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

10 1717 Westmount Road NW | Hillhurst | Apartment

10 1717 Westmount Road NW Hillhurst Calgary T2N 3M4 $235,000Residential- Status:

- Active

- MLS® Num:

- A2208421

- Bedrooms:

- 1

- Bathrooms:

- 1

- Floor Area:

- 496 sq. ft.46 m2

This bright and south-facing one-bedroom, one-bathroom condo is located in a well-maintained concrete building in the highly sought-after community of Hillhurst. With an unbeatable location just a short walk to downtown and a quick drive to both SAIT and the University of Calgary, this home is an excellent option for students or professionals alike. The unit benefits from renovations completed a few years ago, offering a clean and comfortable living space that's move-in ready. Enjoy convenient access to parks, playgrounds, restaurants, shopping, public transit, and scenic walking and biking paths along the Bow River. The building features off-street communal parking, assigned storage lockers, and a shared laundry room for added convenience. Pet lovers will appreciate that the building is pet friendly, making it easy to bring your furry companion along. This is a great opportunity to live in one of Calgary’s most vibrant inner-city neighborhoods. More detailsListed by TREC The Real Estate Company- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

3111 3000 Millrise Point SW | Millrise | Apartment

3111 3000 Millrise Point SW Millrise Calgary T2Y 3W4 $280,000Residential- Status:

- Active

- MLS® Num:

- A2180389

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 806 sq. ft.75 m2

Court ordered sale. Welcome to Legacy Estates in Millrise. A lovely 60+ community within walking distance to groceries stores, pharmacy, coffee shops, and restaurants. The central living space of this unit separate the two bedrooms which each have their own bathroom. This unit also boasts a nice semi private patio off of the living room. Wide hallways, elevators, a main dining area, sitting lounge, exercise room, games area, craft room, library and roof top deck make this building inviting and contribute to the community feel. More detailsListed by CIR Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

3115 99 Copperstone Park SE | Copperfield | Apartment

3115 99 Copperstone Park SE Copperfield Calgary T2Z 5C9 $299,900Residential- Status:

- Active

- MLS® Num:

- A2203410

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 802 sq. ft.74 m2

Discover the charm and convenience of this spacious 2-bedroom, 2-bathroom condo nestled in the family-friendly community of Copperfield. Ideally situated close to parks, playgrounds, schools, shopping, bike and walking paths, and with easy access to transit and the city’s ring road, this location offers the perfect blend of peaceful suburban living with quick city connectivity. Inside, the open-concept layout creates a welcoming flow, with bedrooms thoughtfully placed on opposite sides for enhanced privacy. The primary bedroom boasts a private ensuite, while an additional 4-piece bathroom serves guests. Located on the main level, this unit features a cozy patio – perfect for enjoying summer evenings. In-unit laundry adds convenience, and with two titled parking stalls, including one in the secure underground parkade, and ample visitor parking, this condo meets all your practical needs for easy living. Book your private viewing today. More detailsListed by TREC The Real Estate Company- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

93 1555 Falconridge Drive | Falconridge | Row/Townhouse

93 1555 Falconridge Drive Falconridge Calgary T3J 1L8 $299,900Residential- Status:

- Active

- MLS® Num:

- A2181592

- Bedrooms:

- 3

- Bathrooms:

- 2

- Floor Area:

- 1,205 sq. ft.112 m2

Welcome home to this charming 3-bedroom townhome, nestled in a convenient and family-friendly location! The main floor boasts a spacious kitchen/dining area, perfect for meal preparation and gatherings, along with a cozy living room that flows seamlessly into the private fenced backyard—ideal for outdoor activities and relaxation. You'll also find a handy 2-piece bathroom on this level for added convenience. The home has seen several updates over the years, including a new stove and a vented heavy-duty hood fan. The unfinished basement offers additional space for storage or entertainment, providing endless possibilities to make it your own. Families will appreciate the proximity to amenities, including the nearby Sportsplex, shopping centers, schools, and a bus stop just steps away on 68th Street, offering a short commute to the LRT line. The well-maintained Windfields complex also features a private park for children, plenty of guest parking, and more. With just over 1,000 sq ft of living space, this well-maintained townhouse is an excellent choice. The upper floor features three generous bedrooms and a 4-piece bathroom. You'll also love the easy access to Stoney Trail, McKnight Boulevard, and other essential services. At this price point, you can't go wrong. Call your favorite realtor today for a showing! More detailsListed by RE/MAX Real Estate (Central)- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

4402 155 Skyview Ranch Way NE | Skyview Ranch | Apartment

4402 155 Skyview Ranch Way NE Skyview Ranch Calgary T3N 0L4 $310,000Residential- Status:

- Active

- MLS® Num:

- A2209039

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 900 sq. ft.84 m2

BRIGHT & OPEN 2 BEDROOM + 2 FULL BATH CONDO with TWO TITLED PARKING, in the desirable community of Skyview! Just steps away to playground, schools, shopping + restaurants. 911+ sqft condo ideal for first time buyer, INVESTOR or someone looking to downsize. Open floor plan featuring LARGE living room, chef’s kitchen with ss appliances, quartz countertops, full-height cabinetry + breakfast nook. Exceptional value with QUICK access to CrossIron Mall, Airport, Stoney Trail, Country Hills Blvd & Deer Foot. This is the PERFECT place to call home! More detailsListed by RE/MAX House of Real Estate- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

4118 99 Copperstone Park SE | Copperfield | Apartment

4118 99 Copperstone Park SE Copperfield Calgary T2Z 5C9 $324,900Residential- Status:

- Active

- MLS® Num:

- A2212256

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 915 sq. ft.85 m2

*This property is a judicial listing*.. Offering a 2 bedroom , 2 bathroom unit with unbeatable convenience and modern living in a highly sought-after location. This home has a spacious layout and an open concept living area boasting plenty of natural light. Additional highlights include stainless steel appliances, in-unit laundry, a TITLED UNDERGROUND PARKING STALL WITH STORAGE, A/C and ample cabinetry. Perfectly positioned for easy access to everything you need, this home is just steps away from nearby playgrounds, making it ideal for families or those who enjoy outdoor space. With major amenities, shopping centers, and dining options within close reach, you'll never have to venture far for your essentials. Plus, enjoy quick access to major highways, ensuring an effortless commute whether you’re heading to work or exploring the city. Come visit this home today! More detailsListed by First Place Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

4512 44 Avenue NE | Whitehorn | Semi Detached (Half Duplex)

4512 44 Avenue NE Whitehorn Calgary T1Y 6A9 $349,900Residential- Status:

- Active

- MLS® Num:

- A2207573

- Bedrooms:

- 2

- Bathrooms:

- 3

- Floor Area:

- 840 sq. ft.78 m2

This half duplex is a perfect opportunity for Investors. This property is located in the desirable community of Whitethorn. This bungalow offers 3 bedrooms and 3 full baths. The home has a separate entrance leading to an illegal suite with a kitchen, dining and family room. Many amenities are nearby, such as the C-train, hospital, playground, shopping, schools, and parks. There is parking at the back. More detailsListed by CIR Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

420 40 Carrington Plaza NW | Carrington | Apartment

420 40 Carrington Plaza NW Carrington Calgary T3P 1X7 $385,000Residential- Status:

- Active

- MLS® Num:

- A2208031

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 836 sq. ft.78 m2

This property presents a fantastic opportunity for both first-time homebuyers and investors. It boasts two generous bedrooms, two full bathrooms, and heated underground parking. The property is upgraded with high-end finishes and appliances, complemented by a bright, neutral color scheme. The unit also includes a spacious balcony and 9-foot ceilings. Ideally located in the newer community of Carrington, it offers easy access to a variety of amenities right across the street, plus direct access to Stoney Trail. Don’t miss the chance to own this beautiful, convenient property! More detailsListed by Century 21 Masters- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

117 Chaparral Valley Gardens SE | Chaparral | Row/Townhouse

117 Chaparral Valley Gardens SE Chaparral Calgary T2X 0P9 $408,000Residential- Status:

- Active

- MLS® Num:

- A2180868

- Bedrooms:

- 3

- Bathrooms:

- 3

- Floor Area:

- 1,165 sq. ft.108 m2

This fully developed 3-bedroom, 2.5-bathroom townhome in Riverside Towns offers the perfect blend of comfort, convenience, and modern living. Located in a highly sought-after area, it is just minutes away from the natural beauty of Fish Creek Park, scenic walking paths, schools, and shopping, making it an ideal spot for families and outdoor enthusiasts alike. The main floor features a spacious living room with a cozy gas fireplace, perfect for relaxing or entertaining. The open-concept kitchen boasts an island, pantry, and plenty of cabinet space, flowing seamlessly into the dining room. From here, step through the patio doors to your private, fenced backyard, ideal for outdoor gatherings or quiet moments. Upstairs, you'll find three generously sized bedrooms, including a king-sized primary suite complete with a walk-in closet and a full 4-piece ensuite bathroom. The lower level is fully developed, offering a cozy family room where kids can play or the family can enjoy movie nights together. Additional highlights include 2 parking stalls, ensuring convenience and ease. More detailsListed by RE/MAX First- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

3403 33 Street SE | Dover | Detached

3403 33 Street SE Dover Calgary T2B 0V7 $461,000Residential- Status:

- Active

- MLS® Num:

- A2201369

- Bedrooms:

- 3

- Bathrooms:

- 2

- Floor Area:

- 1,782 sq. ft.166 m2

Calling all Investors.Developers.Bargain Hunters. COURT SALE - CONER LOT - 50' WIDE LOT - BIG 24 X 26 DOUBLE ATTACHED GARAGE. This charming home, being sold by the Court of Kings Bench, is situated on a spacious corner lot and boasts an oversized double attached garage. With 3 bedrooms and 2 bathrooms, this property offers plenty of space for a growing family or potential rental income. Although in need of some tender loving care, this home presents a great investment opportunity for those willing to put in the work. Don't miss out on the chance to make this diamond in the rough shine again! Book your showing today. More detailsListed by LPT Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

202A 500 Eau Claire Avenue SW | Eau Claire | Apartment

202A 500 Eau Claire Avenue SW Eau Claire Calgary T2P 3R8 $510,000Residential- Status:

- Active

- MLS® Num:

- A2195057

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 1,759 sq. ft.163 m2

* Judicial Sale- Investor’s Opportunity* Discover the potential of this prime downtown residence at the prestigious 500 Eau Claire address. Perfectly positioned for convenient access to shopping, top-tier restaurants, and cultural attractions, this 1759 sq. ft. 2-bedroom, 2-bathroom home offers an incredible opportunity to refresh and personalize its interior. Located on the second floor above a 24-hour manned concierge service/ security entrance, the spacious living and dining areas, along with the kitchen, are filled with natural light. The primary suite has three-piece ensuite and a walk-in closet, while a titled underground parking space adds to the convenience. Residents enjoy a full suite of premium amenities, including: Indoor swimming pool & hot tub, Fully equipped fitness, Community gardens, BBQs & outdoor entertaining areas, car wash bay. Condo fees include heat, electricity, and water, plus all amenities. Don't miss this rare opportunity! More detailsListed by Real Broker- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

217 Silverado Plains Close SW | Silverado | Detached

217 Silverado Plains Close SW Silverado Calgary T2X 0J2 $535,000Residential- Status:

- Active

- MLS® Num:

- A2196097

- Bedrooms:

- 4

- Bathrooms:

- 4

- Floor Area:

- 1,304 sq. ft.121 m2

Welcome to this bright and inviting 4-bedroom, 3.5-bathroom home nestled in the highly sought-after community of Silverado. This home offers a perfect blend of comfort and functionality, making it an ideal starter home or a great choice for families. The main floor boasts an open-concept design, seamlessly connecting the living room, kitchen, and dining area. The space has plenty of natural light, creating a warm and welcoming atmosphere. The kitchen features ample storage, and a central island, perfect for family gatherings and entertaining. The dining area opens directly to the backyard patio, extending your living space outdoors in the summer. Upstairs, the primary suite has its own ensuite bathroom, offering a private and peaceful escape. Three additional bedrooms provide plenty of space for family members, guests, or a home office. The 3.5 bathrooms throughout the home ensure convenience for all. Outside, the backyard is ready for your personal touch, with a parking pad in the back and additional street parking available out front. Silverado is known for its family-friendly atmosphere, with parks, playgrounds, and schools just a short stroll away. You'll also enjoy easy access to local amenities, shopping, dining, and recreational opportunities. This property is a judicial listing, offering a unique opportunity in this vibrant community. Don't miss out on the chance to make it your own! More detailsListed by CIR Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

2303 615 6 Avenue SE | Downtown East Village | Apartment

2303 615 6 Avenue SE Downtown East Village Calgary T2G 1S2 $539,000Residential- Status:

- Active

- MLS® Num:

- A2209266

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 964 sq. ft.90 m2

Discover this stunning 2-bedroom, 2-bathroom luxury condo that redefines city living. Located in the vibrant East Village, this home boasts breathtaking 180° views of the Bow River, Stampede Park, and the iconic Calgary Tower from nearly every angle—living room, bedrooms, and your expansive sheltered balcony. This is your front-row seat to the dynamic cityscape. The open-concept layout is thoughtfully designed for effortless living, offering an inviting atmosphere ideal for entertaining or simply unwinding. Impeccable high-end finishes, including sleek quartz countertops, integrated custom-panel appliances, and the convenience of in-suite laundry, elevate your living experience. Whether you’re preparing a gourmet meal in the modern kitchen or enjoying Calgary's skyline from your couch, every moment in this home feels extraordinary. The spacious primary bedroom retreat is a serene haven, complete with a spa-inspired ensuite. Dual sinks, a luxurious soaker tub, and a generously sized walk-in shower provide both elegance and functionality. This development offers an array of premium amenities. From working remotely in the owners' lounge with complimentary WiFi to enjoying the spectacular 360-degree views from the observation decks, every detail has been crafted to complement your lifestyle. Host gatherings in the beautifully appointed entertainment room, stay active in the modern gym, or simply relax knowing you’re part of one of Calgary’s most sought-after buildings. In addition to the incredible features of the condo and its building, East Village places you steps away from some of Calgary’s best dining, shopping, and recreational experiences. Walkable, vibrant, and engaging, the neighborhood offers the ultimate urban lifestyle. Complete with 2 TITLED underground parking stalls and a designated storage locker, this property is a rare opportunity to own a piece of Calgary's most exciting neighborhood. This isn't just a condo—it's a lifestyle. Thoughtfully designed with every detail in mind, you’ll find luxury, comfort, and convenience in every corner. Experience the very best of downtown living today!-- More detailsListed by RE/MAX House of Real Estate- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

4107 46 Avenue SW | Glamorgan | Detached

4107 46 Avenue SW Glamorgan Calgary T3E 1N5 $545,000Residential- Status:

- Active

- MLS® Num:

- A2210077

- Bedrooms:

- 1

- Bathrooms:

- 1

- Floor Area:

- 999 sq. ft.93 m2

**THIS IS A FORECLOSURE** and great development opportunity. The property has had recent fire damage + no access is allowed into the house. It is possible to walk the property but please book a showing to do so. Great development potential in this Glamorgan neighbourhoood and offering excellent location. This property has not been listed for many years + offers a 50 X 100 foot lot with a South facing backyard. More detailsListed by Real Estate Professionals Inc.- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

47 SADDALEBACK Way NE | Saddle Ridge | Detached

47 SADDALEBACK Way NE Saddle Ridge Calgary T3J 4K4 $599,000Residential- Status:

- Active

- MLS® Num:

- A2179686

- Bedrooms:

- 4

- Bathrooms:

- 3

- Floor Area:

- 1,682 sq. ft.156 m2

EXCELLENT LOCATION! few minutes walk to SADDLETOWN LRT Station and # 23 BUSES . DON'T MISS this 3 BEDROOM, 2 and Half WASHROOMS ,2 STOREY home with FULLY FINISHED BASEMENT and DOUBLE ATTACHED GARAGE located in HEART of SADDLE RIDGE. This beautiful, bright, with 9 FOOT knockdown CEILINGS, open concept living room, dining room, and kitchen complete with GRANITE COUNTERTOPS, LARGE ISLAND, . Laundry room and 2 piece bathroom round out a very functional main floor layout. Upstairs is a bonus room featuring a gas fireplace, SPACIOUS PRIMARY BEDROOM with 4 piece ensuite and walk-in closet, 4 piece main bathroom, and 2 good sized additional bedrooms. The fully finished basement with a Large Bedroom or family recreation area. The deck has been converted to a SUNROOM AND THE yard is fully fenced. There some hail damage on the sidings , and might be on the roof Shingles as well. More detailsListed by URBAN-REALTY.ca- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

3 1922 9 Avenue SE | Inglewood | Row/Townhouse

3 1922 9 Avenue SE Inglewood Calgary T2G 0V2 $599,900Residential- Status:

- Active

- MLS® Num:

- A2191226

- Bedrooms:

- 2

- Bathrooms:

- 5

- Floor Area:

- 2,948 sq. ft.274 m2

Live-Work Space in Prime Inglewood Location. This unique, centrally located property offers over 3,000 sqft of versatile living and commercial space across four levels in the heart of Inglewood. Perfectly for those looking to combine business and lifestyle, this property features an upper residential unit with rooftop patio, main floor commercial space, and a finished basement with additional storage. The spacious upper unit boasts 3 bedrooms, 2.5 bathrooms, and an open-concept living area, providing ample room for comfort and modern living with laundry off the main living area. The floorplan is ideal for both relaxation and entertaining, with natural light flowing throughout. Most recently rented for $2200/month (2024). The main floor features a well-appointed commercial space, currently set up with a reception area, 2 private offices, and a convenient powder room. With approximately $15/sqft (base rent) rental potential, this space provides an excellent opportunity for a variety of business ventures in an up-and-coming neighborhood. The fully finished basement adds significant value, offering additional storage and a second powder room, ideal for both personal and business use. This unit also comes with a stall directly adjacent the front door. With its prime location and diverse usage potential, this property offers a rare opportunity to live, work, and thrive in the highly sought-after Inglewood community. More detailsListed by Century 21 Masters and Elevate Property Management- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

7 4907 8 Street SW | Britannia | Apartment

7 4907 8 Street SW Britannia Calgary T2S 2P1 $599,900Residential- Status:

- Active

- MLS® Num:

- A2197732

- Bedrooms:

- 2

- Bathrooms:

- 2

- Floor Area:

- 1,149 sq. ft.107 m2

Spacious 2 bedroom , 2 bathroom ground floor, end unit in a quiet, exclusive building within the prestigious community of Britannia. A large foyer with dual closets effortlessly tucks away jackets, shoes and bags. The elegant living room with crown molding invites relaxation in front of the gas fireplace. Large patio sliders stream in natural light and provide access to the private patio encouraging casual barbeques and time spent unwinding. A large dining area allows you entertain easily. Clear sightlines into the white, neutral kitchen promote unobstructed conversations. The primary bedroom is exceedingly large with a custom walk-in closet and a 5-piece ensuite for ultimate luxury! French doors open to reveal the large den for a tucked away work or hobby space or even use as a guest room thanks to the close proximity to the 4-piece bathroom. In-suite laundry, underground parking and a separate storage room further add to your comfort and convenience. This well-maintained home is outstandingly located within walking distance to exceptional amenities including Sunterra Market, Village Ice Cream, Grumans Delicatessen, Lina’s Italian Mercato, Browns Social House, the Calgary Golf and Country Club and the tranquil Elbow River. Book a showing to see for yourself! More detailsListed by Real Broker- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

7803 Hunterslea Crescent NW | Huntington Hills | Detached

7803 Hunterslea Crescent NW Huntington Hills Calgary T2K 4M3 $645,000Residential- Status:

- Active

- MLS® Num:

- A2212715

- Bedrooms:

- 3

- Bathrooms:

- 2

- Floor Area:

- 1,132 sq. ft.105 m2

Handyman special located in Huntington Hills, NW Calgary. This 1,591 sq ft of total living space 3 level split offers a large kitchen, dining room, and living room. Three bedrooms and a four-piece bathroom on the main floor. The basement includes a large living room, two-piece bathroom, laundry area, and storage space. Also features a mudroom, large deck, and double detached garage. Located close to schools, shopping, bike paths, walking paths, and aquatic centers. More detailsListed by CIR Realty- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

-

4347 2 Street NW | Highland Park (Calgary) | Semi Detached (Half Duplex)

4347 2 Street NW Highland Park Calgary T2K 0Z2 $675,000Residential- Status:

- Active

- MLS® Num:

- A2204711

- Bedrooms:

- 4

- Bathrooms:

- 4

- Floor Area:

- 1,745 sq. ft.162 m2

Nestled in the heart of a quaint suburban neighborhood of Highland Park, this charming property exudes timeless elegance and modern comfort.Upon entering, the gleaming hardwood floors and abundance of natural light create a welcoming atmosphere. The living room, adorned with a two-sided fireplace, provides a cozy space to unwind, while French doors lead to a versatile flex room, perfect for a home office or children's play area. The dining room, adjacent to the fireplace, sets the stage for elegant gatherings, complemented by an expansive kitchen designed for culinary enthusiasts. Featuring a large center island, gas stove and double-door refrigerator, and plenty of counter space, this kitchen is both functional and stylish. An enclosed pantry adds extra storage convenience. Upstairs, a curved staircase leads to the master suite, a tranquil retreat complete with a custom walk-in closet, private balcony with sunset views, and a luxurious 5-piece ensuite featuring a skylight, double vanity, soaker tub, and separate shower. Two additional bright and spacious bedrooms share this level, along with a conveniently located laundry area. The finished basement offers additional living space with a rec room for movies and games, a fourth bedroom, another full bathroom, and ample storage. Outside, the west-facing backyard is perfect for enjoying sunny days on the full-width deck, surrounded by mature trees and a fenced grassy yard ideal for family activities. An insulated double detached garage provides parking convenience. Close to School, transit, shopping easy access to Centre street and 4th Street. Call to view before it's gone!. More detailsListed by RE/MAX House of Real Estate- Jerry Charlton

- Exp Realty

- 403 831 0842

- Contact by Email

Discover Calgary Foreclosures

Calgary's foreclosure market offers unique opportunities for savvy buyers and investors. Whether you're looking for a great deal on a home or are interested in understanding how foreclosure sales work in Calgary, our expert insights can help.

Stay updated with the latest foreclosure trends, tips, and listings. Our blog covers everything you need to know to navigate the Calgary foreclosure market.